//

How OFS Group Unlocked $842,000 in Trapped Cash with AI‑Driven A/R Modernization

Modernizing receivables, unlocking cash

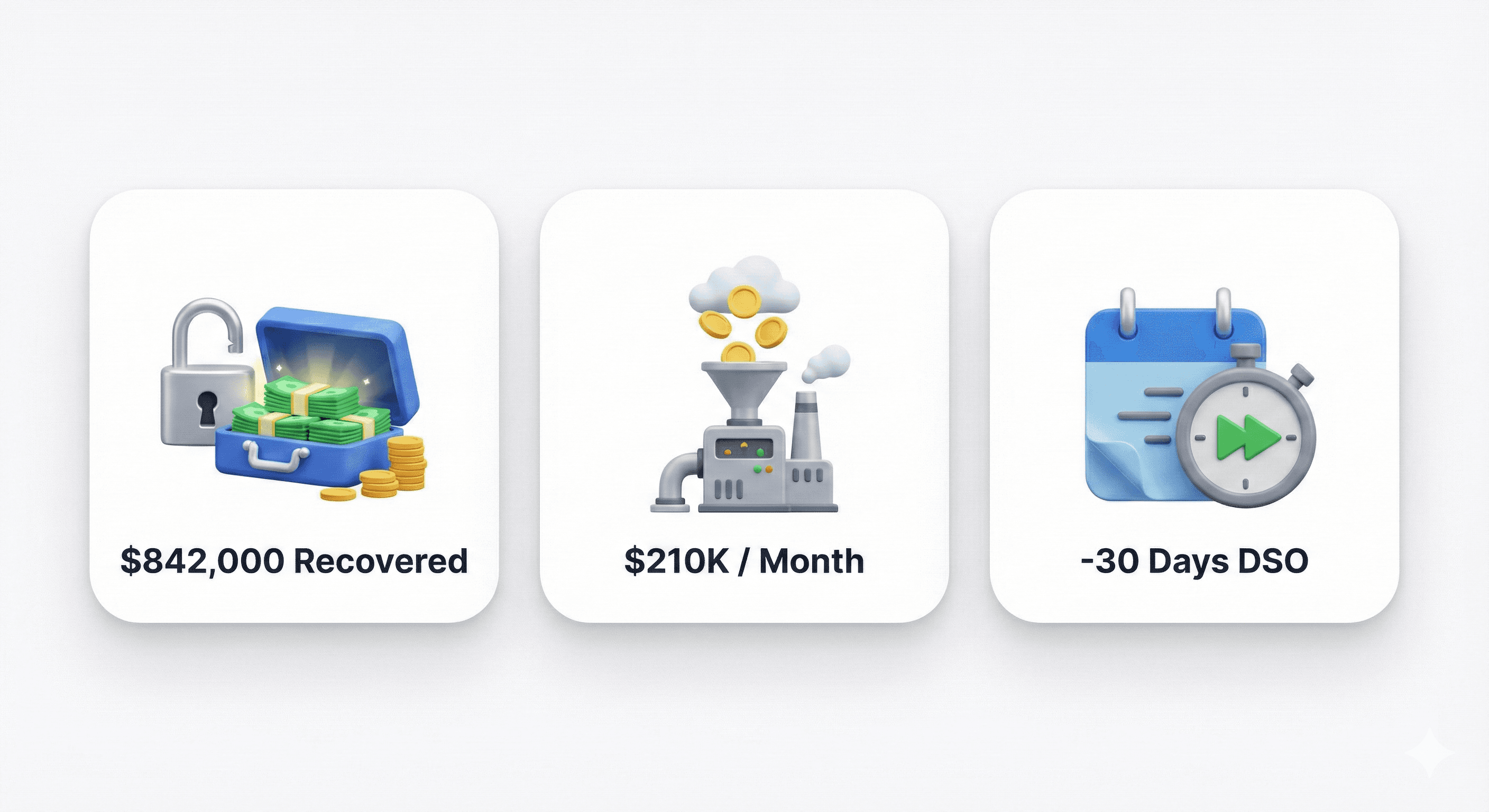

In four months, OFS Group:

Recovered $842K in overdue invoices

Brought in nearly $210K per month in previously delayed payments

Reduced DSO by more than 30 days, improving the predictability of cash inflows

About OFS Group

Ough Fire Systems Ltd., operating as OFS Group, is an Ontario‑based fire protection and commercial appliance service provider. Since 1966, they have supported commercial, industrial, hospitality and institutional clients with safety‑critical and operational services.

The Challenge

As OFS Group expanded and transitioned between internal systems, billing volume and complexity increased. Multiple service types, contract structures and payment terms meant invoices moved through the cycle at different speeds, and over time more balances began to age than the team wanted to see.

Leadership set out to modernize receivables in a way that would support growth and cash flow while staying consistent with OFS’s customer experience. They wanted to:

Reduce Days Sales Outstanding and shorten the cash conversion cycle

Unlock working capital tied up in overdue invoices

Spend less time on manual chasing while maintaining a professional, steady tone with customers

They needed a scalable approach that would improve reliability and visibility without adding headcount or changing how customers interacted with the company.

The Abivo Approach

Abivo deployed a conversation-driven collections engine powered by an intelligent AI voice agent named Kate that speaks with customers like a trained AR specialist.

Rather than relying on generic reminders, Kate:

Calls customers about outstanding invoices using current balance, due date and history data

Holds natural payment conversations, adapting to timing, questions and short‑term constraints

Clarifies disputes, handles timing objections and confirms what each customer is prepared to do next

Captures promises to pay, preferred dates and follow‑up needs, then syncs a clear summary into Abivo’s dashboard so the OFS team can see issues and next steps at a glance

The result is a receivables process that feels like a consistent team member: always on, always documented and always in the same professional tone.

Results

Within four months of going live, starting in the first week of deployment, OFS Group saw clear financial and operational gains:

$842,518 recovered in overdue payments, returning trapped cash to the business

DSO reduced by more than 30 days, as invoices moved more reliably through the cycle

A stronger working capital position, giving leadership more flexibility in planning and investment

Internal effort refocused – the team went from four callers to one, with Kate handling most customer conversations so staff could concentrate on analysis and forward‑looking work

Improved visibility into account status, with summaries showing commitments, next steps and any open customer issues

The collections process not only accelerated recovery, it became a stable, scalable part of how receivables are managed going forward.

Client Perspective

“We wanted to bring more structure to receivables as the business continued to grow, but it was important that any change still felt like us. Abivo understood that from the start.

Kate fit into our process naturally. Calls are handled in a steady, professional tone, and the details from each conversation are easy for our team to review. It has made it simpler to see where accounts stand and what is coming in next.

The impact on cash flow has been clear, and the process now runs quietly in the background, supporting the work our team is already doing.”

— OFS Group Leadership