//

Strategic Credit Terms And Policy Guide For Service Based SMBs In 2025

In 2025, the biggest risk for many service based SMBs is not a lack of demand, it is a lack of liquidity. Late payments have shifted from being an exception to part of the baseline. A recent B2B payment practices study for the United States reports that around half of all B2B invoices on credit are now overdue and that bad debts account for a material share of credit based sales in several sectors.

Small businesses feel this most directly. The 2025 US Small Business Late Payments Report finds that firms with outstanding invoices are owed more than 17,000 dollars on average and that late payments are closely tied to reported cash flow stress. For service providers that sell time, expertise, and often upfront materials, extending credit under these conditions is essentially unsecured lending.

This guide reframes credit terms as a strategic instrument, not boilerplate. It focuses on service based SMBs and startups in trades, healthcare, and professional services, and it connects policy design with A/R automation platforms like Abivo so that the terms you set actually show up as cash in the bank.

Why 2025 Requires A Different Credit Strategy

Macro conditions are reshaping payment behavior across markets. In the United States, recent trade credit research shows that a majority of B2B sales on credit are now paid late and that bad debts are rising in several industries, which has pushed many companies to strengthen credit risk management and rely more on tools such as credit insurance and factoring.

In Western Europe, the issue is longer payment cycles. A 2025 overview of European payment practices shows that average B2B payment terms have lengthened to more than 50 days, up from about 40 days the year before, and that a significant share of invoices are written off as uncollectable. Construction and machinery often run the longest terms, which creates additional strain for service suppliers tied into those projects.

For a US based service SMB, this broadly means:

Domestic customers require stronger enforcement and risk screening, because overdue invoices are now a structural feature of the market.

International customers, especially in Europe, require longer liquidity planning, since standard terms in some markets already exceed 50 days.

A single generic “net 30 for everyone” policy no longer reflects this reality.

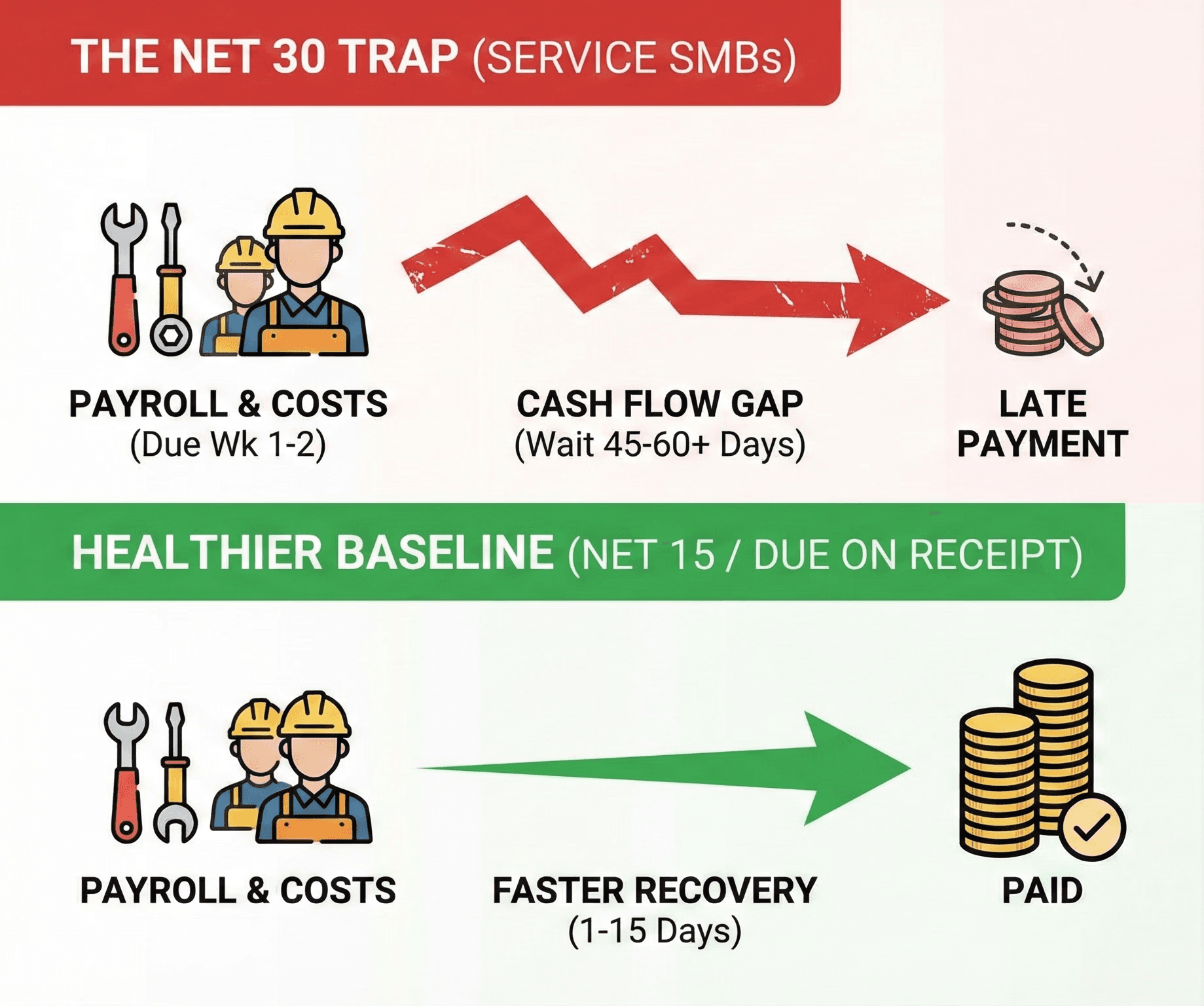

The Net 30 Trap For Service Based SMBs

Net 30 has become a default term in many B2B industries, often copied from templates without much thought. Practical guides on net payment terms point out that offering credit can support sales and relationships, but they also highlight the higher risk of late payment and the strain on cash if terms are not aligned with a company’s cost structure.

For service businesses, the risk is sharper because:

Payroll and subcontractor bills typically fall due within 1 to 2 weeks of the work being done.

Materials are often purchased upfront for jobs.

There is no inventory to recover if the client never pays.

In practice, net 30 often turns into net 45 or net 60. Larger customers may interpret “30 days” from invoice receipt, approval, or end of month, so the real days sales outstanding (DSO) drifts well beyond the written terms. Recent late payment statistics roundups show that this drift is exactly what has pushed the share of overdue invoices above 50 percent in several markets.

For many service SMBs, a healthier baseline is:

Net 15 for most projects and recurring work.

Due upon receipt for one off, low ticket, or fully digital services.

Shorter terms reduce the duration of the “interest free loan” you extend to customers. They also make it easier to connect specific work to specific payments before memories fade and disputes become more likely.

Rethinking Early Payment Discounts: Liquidity At A Price

Early payment discounts, especially the familiar “2/10 net 30,” are powerful but often misunderstood. Under these terms, a buyer receives a 2 percent discount if they pay within 10 days, otherwise the full amount is due in 30 days.

Technical explainers on early payment discount math and working capital impact show that the annualized return for the buyer is roughly 36 to 37 percent for paying 20 days early. That is a very high implied interest rate on the short term “loan” the supplier is effectively making.

For a service business, the discount decision should be numeric, not emotional:

If your alternative cost of capital, such as a bank line, is much lower than that implied rate, widespread discounts are expensive and should be used sparingly.

If you are regularly forced onto costly credit to cover payroll because of slow payments, using discounts on selected segments to pull cash forward can be rational.

Early payment discounts are not a universal best practice. They are a priced liquidity tool that should be targeted at the customers and situations where faster cash materially reduces risk.

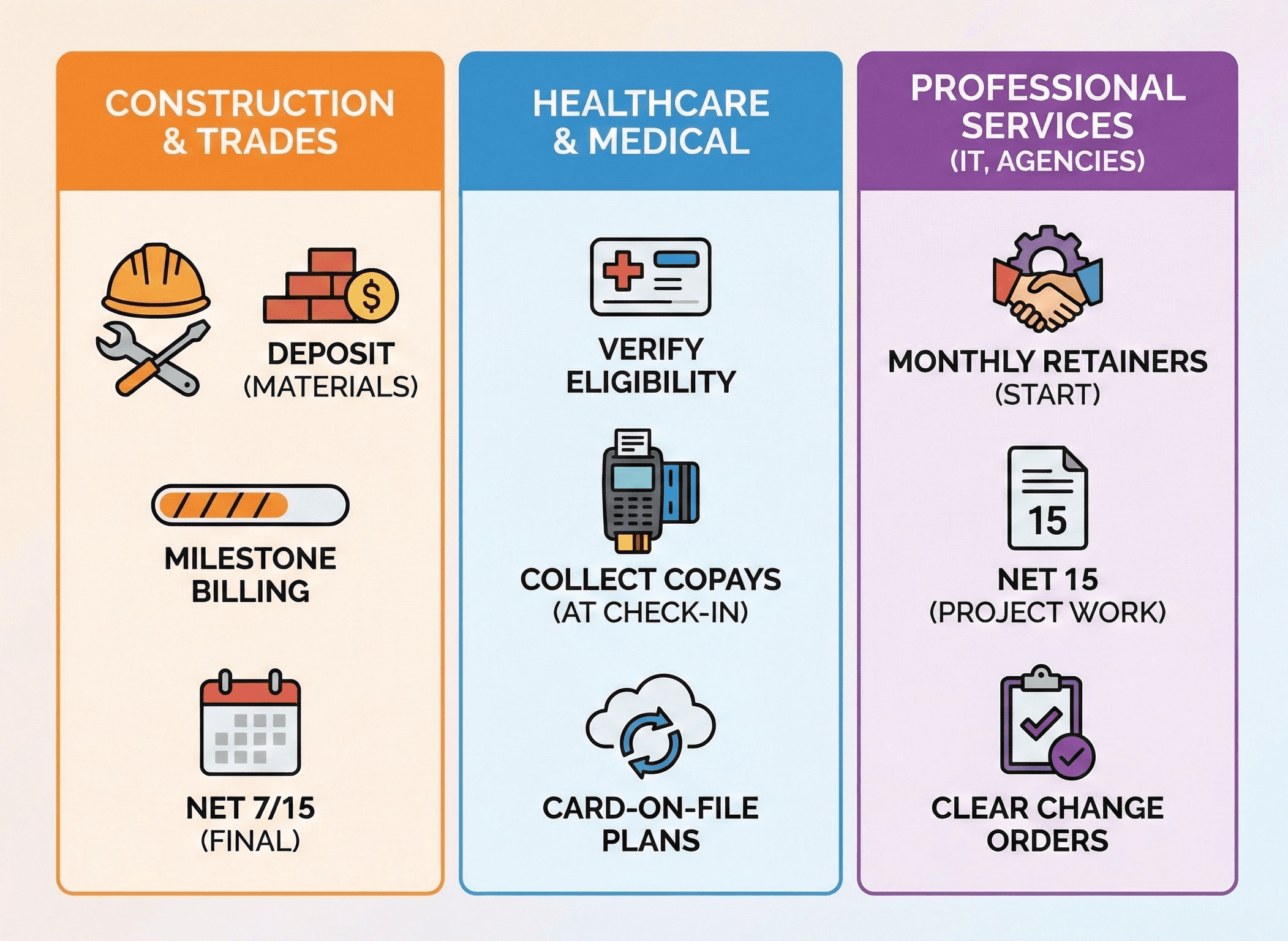

Sector Specific Credit Playbooks For Service Providers

A single credit policy rarely fits every service vertical. The economics in construction, healthcare, and professional services are different, so payment structures should be different too.

Construction, Trades, And Home Services

Construction and commercial trades face material volatility and project based risk. Industry commentary on construction cash flow and materials inflation notes that sectors like construction and steel already operate on some of the longest payment terms, which amplifies working capital strain for smaller contractors.

For contractors and home services, a more resilient structure is:

Substantial deposit before scheduling work, often 30 to 50 percent to cover materials.

Milestone billing tied to events such as material delivery, inspection, or substantial completion.

Short final terms, for example net 7 or net 15, on the remaining balance.

Mechanic’s lien rights in many jurisdictions provide a legal backstop but should remain a last resort. A clear staged payment schedule and upfront discussion about terms usually prevents reaching that point.

Healthcare And Medical Practices

Healthcare billing is complicated by insurers, high deductible plans, and patient confusion. Revenue cycle best practice guides on clinic collections stress the importance of point of service collections and clear financial responsibility to limit bad debt from small, aging balances.

Practical moves for clinics include:

Eligibility and benefits verification before visits so patients understand likely out of pocket costs.

Collecting copays and known deductibles at check in.

Using card on file and small automated payment plans for larger patient balances.

Here, the “credit term” is less about days printed on an invoice and more about how quickly the patient portion is converted into a realistic, automated plan.

Agencies, IT, And Professional Services

Agencies, consultancies, and IT firms wrestle with scope creep and intangible deliverables. Healthier models treat credit as part of relationship design, not an afterthought.

Patterns that work well include:

Monthly retainers paid at the start of the period, which turn lumpy project risk into predictable recurring revenue.

Net 15 on project work outside the retainer, to avoid 60 to 90 day delays that can cripple smaller firms.

Clear change order processes so additional work is approved, priced, and scheduled for billing in advance.

Guides on contractor payment schedules and professional service billing consistently highlight that closing the gap between work performed and invoices sent is one of the most effective ways to reduce payment disputes.

Modern Credit Vetting And Dynamic Limits

Extending trade credit is lending by another name. In 2025, granting open net 30 terms to every new business customer has become risky.

A robust but manageable process for SMBs usually includes:

A commercial credit application that collects legal entity details, responsible owners or officers, and explicit acceptance of your payment terms and late fee policy. Practical templates and guidance are widely available, such as this business credit application guide.

Permission to obtain business credit reports from providers and education on interpreting business credit scores so that payment experience informs your limits.

Trade and bank references for larger exposures, especially in sectors with known stress, such as machinery and chemicals, which recent sector payment overviews identify as running higher bad debt levels.

The limit itself should be dynamic. A practical approach is:

Start new accounts on a modest limit and, where appropriate, partial prepayment.

Increase limits once a client has paid several cycles on time.

Reduce or freeze limits when payments slip or external data shows increased risk.

Emerging tools that use alternative credit data and cash flow analytics help fill gaps for younger companies with thin files and make it easier to see changes in risk earlier than traditional reports.

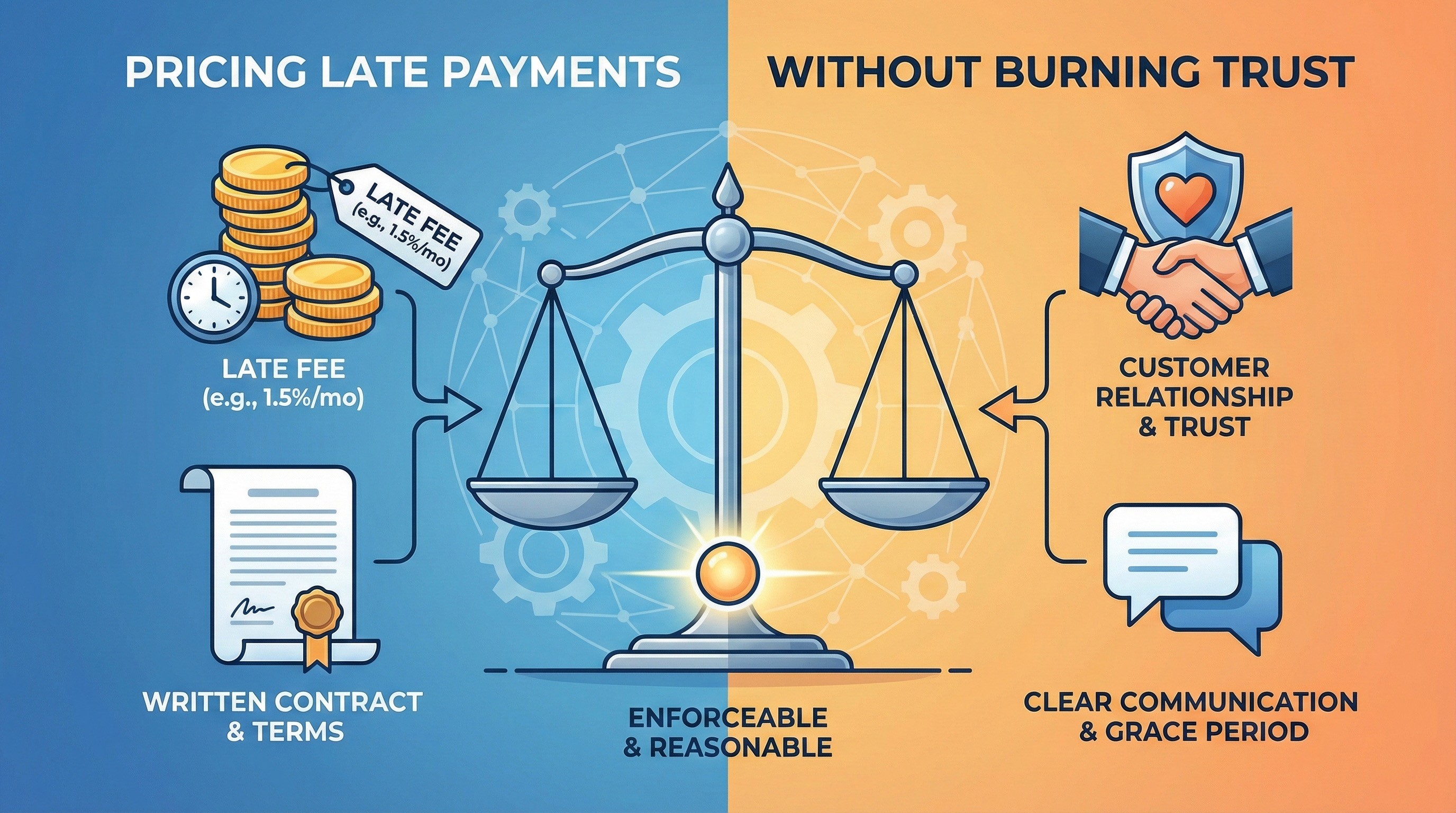

Pricing Late Payments Without Burning Trust

A due date with no consequence is only a suggestion. Late fees and finance charges are the mechanism that turns your terms into a real priority for customers, but they must be both enforceable and reasonable.

Current late fee law summaries by state show that more than 30 US states have no explicit statutory cap for B2B late fees provided they are reasonable and agreed in writing, while others cap effective rates in a defined range. Practical guides on charging late fees on invoices consistently emphasize three points:

Late fees must appear in the written contract or credit terms to be enforceable.

A short grace period, often 5 to 7 days, is considered best practice, even where not mandated.

A monthly rate of around 1.5 percent (about 18 percent annually) is commonly used in B2B settings where no stricter cap applies.

For context, the US federal Prompt Payment framework uses an interest rate on overdue government payments that has recently been published in the range of roughly 11 to 12 percent per year, which offers a useful benchmark for what regulators view as reasonable in a public context.

In practice, you can:

State the finance charge on every contract and invoice in plain language.

Apply it consistently, with documented rules for one time waivers where there is a legitimate dispute or hardship.

Position the fee as part of protecting your ability to serve all customers reliably, not as a punishment.

Turning Policy Into Practice With A/R Automation And AI

The weak link in many credit policies is execution. Owners and finance teams know what should happen, but they do not have the time to send dozens of reminders, log calls, adjust cadences by customer behavior, and forecast cash inflows accurately.

This is where AR automation has shifted from nice to have to essential. An independent survey on AI in accounts receivable reports that 99 percent of companies using AI in receivables saw faster payments and that three quarters reduced DSO by six days or more, often without adding headcount.

Platforms like Abivo bring these capabilities within reach of service based SMBs. By integrating directly with systems such as QuickBooks, NetSuite, FreshBooks, Sage, Microsoft Dynamics, Xero, Stripe, Square Invoices, SAP Business One or Ariba, Jobber, ServiceTitan, BuildOps, and Bill.com, Abivo can:

Apply different reminder cadences based on customer segment, risk, and invoice size

Use AI calling and email agents to execute contextual dunning, for example sending a softer reminder to a customer who usually pays a few days late and escalating only when behavior changes.

Orchestrate outreach across email, SMS, and voice, with smart retry logic for failed or ignored contacts.

Feed predictive analytics and risk scores back to finance leaders so they can see which accounts are likely to slip and adjust terms before defaults occur.

The result is that your carefully designed credit policy is applied the same way for the hundredth invoice as for the first, without turning your office into a calling floor.

Negotiating Terms Without Giving Away The Store

Even with robust policies, you will face negotiation pressure, especially from larger customers who ask for net 60 or net 90 as a default. The key is to keep the conversation on economics rather than emotion.

Two practical tactics:

Price the term extension

Explain that your standard pricing assumes net 15 or net 30.

Offer net 60 at a higher fee that reflects your cost of capital over that period, or keep current pricing in exchange for shorter terms or early payment.

This frames longer terms as a service you can provide, not an obligation.

Use policy language with existing clients

When tightening terms and introducing late fees, communicate that you are standardizing policies to protect service quality and supply continuity, not singling anyone out.

Provide 30 days notice, a clear explanation of the new terms, and an invitation to discuss special cases.

Playbooks on negotiating B2B payment terms stress that framing changes around resilience and mutual reliability, rather than punishment, reduces friction and improves acceptance.

In collections conversations, scripts that combine clarity and empathy work best. Reference the specific invoice, due date, and any previous commitments, ask what is blocking payment, and leave with an agreed action and date that you then track in your A/R system.

Checklist For The Next 90 Days

To turn this strategic view into action, a service based SMB can:

Quantify the problem

Measure DSO, the percentage of receivables more than 30 and 60 days overdue, and total working capital tied up in late invoices.

Redesign core terms

Move away from a blanket net 30 default.

Set net 15 or shorter terms for most services, with deposits and milestones where costs are front loaded.

Segment credit policies by sector and behavior

Use different structures for construction, healthcare, and professional services clients.

Introduce a three tier credit model with specific criteria for starting limits, upgrades, and downgrades.

Formalize credit vetting

Implement a standard credit application, use business credit reports for larger exposures, and track payment behavior to adjust limits over time.

Tune discounts and late fees

Recalculate the real cost and benefit of early payment discounts.

Ensure late fees are contractually documented, state compliant, and applied consistently after a short grace period.

Automate execution

Deploy A/R automation, such as Abivo’s AI calling and email agents, to handle reminders, escalations, and logging across systems like QuickBooks, NetSuite, Xero, Stripe, and Square.

Use predictive analytics to identify at risk accounts before invoices age out.

Credit in 2025 is no longer a casual courtesy. For service based SMBs, it is a tightly coupled part of the business model. When you treat credit terms and policies as designable, testable, and automatable, you stop acting as an involuntary bank and start using liquidity as a strategic advantage.