//

Celebrating On-Time Payments: The Psychology of Gratitude in B2B Receivables

Reimagining the Financial Relationship

In B2B commerce, there’s often a disconnect: while sales teams woo customers with personalized service, finance teams later default to transactional, sometimes adversarial processes. Accounts receivable (AR) typically operates in the background, only stepping forward to correct issues. But what if we flipped the script?

Instead of focusing only on late payments, this article explores how service-based SMBs can reinforce promptness by celebrating it. By leveraging behavioral psychology and gratitude, and supported by automation tools like Abivo, finance teams can drive loyalty, improve cash flow, and create positive customer touchpoints.

Late Payments Are More Than Just a Nuisance

The Financial Drain: Research shows that SMBs spend around $39,406 annually managing overdue invoices. That includes time, technology, and the toll of chasing payments. The average small business is owed over $17,000 at any given time. This blocks investment in hiring, marketing, and innovation.

The Time Sink: Around 5% of small businesses spend more than 10 hours per week chasing late invoices. Over a year, that’s more than 500 hours lost to follow-up instead of forecasting or strategy. It also contributes to burnout and low team morale.

Sales vs. Finance Tension: When AR is only heard from when something goes wrong, clients dread contact. Meanwhile, sales teams worry that enforcement will hurt relationships. This leads to inconsistent application of terms, and poor habits from customers.

The Psychology of Prompt Payment

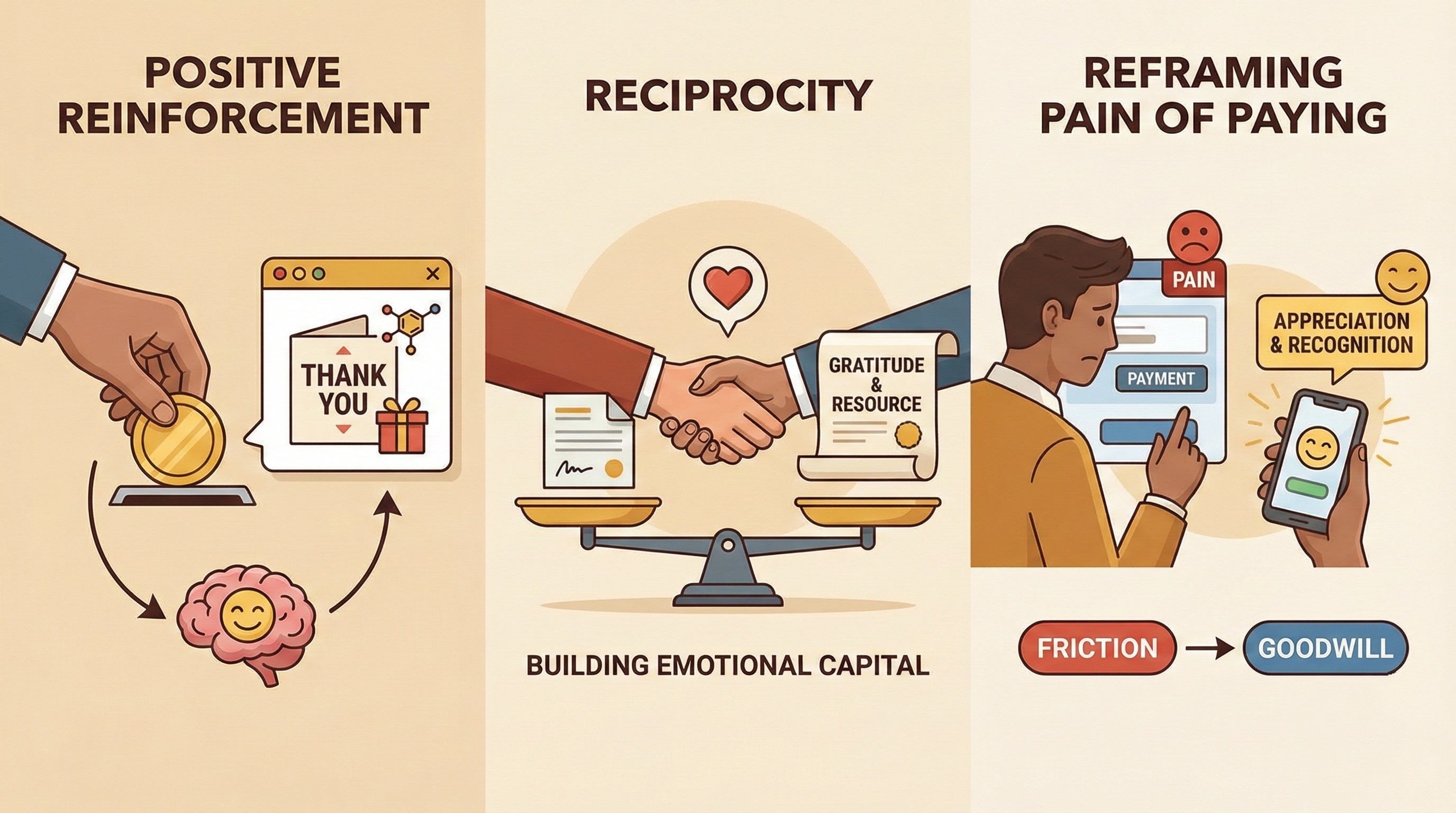

Positive Reinforcement Works

B.F. Skinner’s theory of operant conditioning applies here: when behaviors (like timely payment) are followed by positive reinforcement, they’re more likely to repeat. Yet, many businesses don’t respond to timely payment at all, missing a key opportunity.

A thank-you note or a surprise perk activates the brain’s dopamine response. Over time, clients begin to associate prompt payment with recognition and reward.

Reciprocity and Emotional Equity

Social science shows that people are more likely to return a favor than avoid punishment. Gratitude builds emotional capital. Sending a thank-you note or offering a meaningful resource after a timely payment creates a feeling of goodwill, and a subtle desire to reciprocate.

Reframing the Pain of Paying

Psychologists describe the “pain of paying”, a moment of friction during any transaction. This is heightened in B2B contexts where payment comes after value is already delivered. This is heightened in B2B contexts where payment comes after value is already delivered. By adding recognition to that moment, rather than silence, you reduce the emotional discomfort.

High-Impact, Low-Cost Appreciation Tactics

The Revival of the Handwritten Note

Few things cut through the noise like a handwritten card. Address it to the AP contact, not just the exec. These professionals rarely get thanked, and a small gesture makes a big impression.

Handwritten notes create cognitive stickiness. Studies show that handwritten text is processed more deeply than digital messages.

Social Recognition

LinkedIn shout-outs, client spotlight blog posts, or public mentions in newsletters create value for your client’s brand. With permission, praise your most reliable payers. The reward is status, not just for the individual but for their company.

Gated Access

Offer early access to new features, beta tests, or faster support to clients with excellent payment histories. This “VIP” positioning aligns with human desire for exclusivity and respect.

Educational Gratitude

Reward on-time clients with first access to white papers, curated resources, or free seats in upcoming webinars. These gestures cost little but build stickiness and perceived value.

Redesigning Financial Incentives with Heart

Discounts and perks have long been tools of the trade, but most early-payment incentives feel like cold math problems. It's time to make them relational.

Start with your discount model. Instead of a one-size-fits-all 2/10 net 30 policy, consider a flexible format that rewards clients for any degree of promptness. Maybe a 3% discount for payments made in five days, 2% if paid in ten, or 1% within twenty. The sliding scale still protects your margins while inviting customers to act sooner.

Another way to frame it? Look to the future. Rather than lowering the amount on the current invoice, offer credits toward a future service. This builds anticipation and loyalty. A message like “Pay this invoice by the 20th and receive $100 toward your next quarterly check-in” feels more like an invitation than a transaction.

If you want to go further, loyalty-style rewards can add an element of play. Award points for early payments. Let customers redeem them for extra consulting time, upgraded support, or even donations to a charity in their name. That last one is especially useful for clients with compliance concerns around gifts.

Then, there’s the power of surprise. A client pays on time and, without warning, they receive a handwritten note, an unexpected upgrade, or a waived fee. These moments of delight aren’t just good manners. Psychologically, they're sticky. Humans remember emotional spikes, and unpredictable rewards are some of the most potent reinforcers out there.

The best part? These aren’t expensive changes. They’re thoughtful ones.

Automating Gratitude at Scale

Smart Templates

Your “payment received” email doesn’t need to be a robotic receipt. Turn it into a branded moment of gratitude:

"Thanks for your prompt payment. Your reliability helps us deliver better service. Here’s a guide you might find valuable."

Workflow Triggers

When an invoice is paid, trigger a task in your CRM: “Send thank-you video,” “Mail thank-you card,” or “Schedule loyalty check-in.”

Meet Abivo’s AI Agents

Abivo takes automation to the next level. Its AI agents:

Send nuanced follow-ups by email or voice

Adjust tone based on sentiment

Detect intent (e.g., confusion vs. evasion)

Surface appreciation opportunities by identifying client behavior trends

They free up your team to focus on high-touch actions like relationship-building and strategic planning.

Predictive Recognition

If a client improves payment timing consistently over a few cycles, a predictive system like Abivo can flag them for a custom thank-you. Similarly, slowing payment patterns can trigger outreach to prevent churn.

Structuring the Strategy

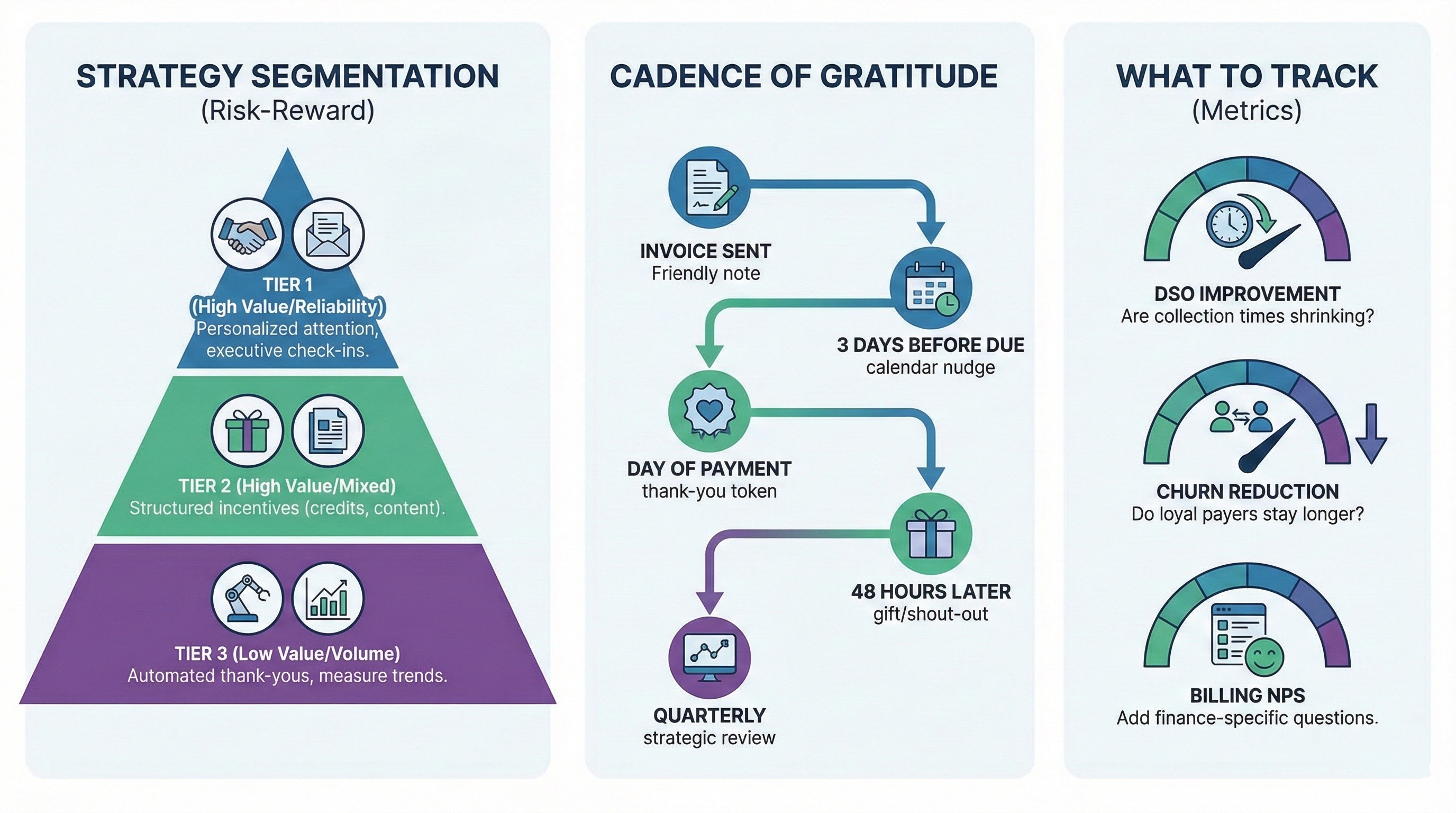

Segmentation

Apply a risk-reward lens to customer groups:

Tier 1 (High Value, High Reliability): Give personalized attention, notes, executive check-ins

Tier 2 (High Value, Mixed Reliability): Offer structured incentives like credits or content

Tier 3 (Low Value, High Volume): Automate thank-yous and measure trends

Cadence of Gratitude

Invoice Sent: Include a friendly note thanking them for their partnership

3 Days Before Due: A gentle nudge that assumes the best

Day of Payment: Trigger a thank-you email or token

48 Hours Later: Deliver content, a gift, or a public shout-out (where appropriate)

Quarterly: Review top payers and deliver strategic recognition

What to Track

DSO Improvement: Are your average collection times shrinking?

Churn Reduction: Do loyal payers stay longer?

Billing NPS: Add finance-specific questions to your customer satisfaction surveys

Stay Thoughtful and Compliant

Avoid Reward Entitlement

Rotate reward types to keep surprises fresh and prevent clients from expecting discounts every time.

Follow Legal Guidelines

For regulated industries, ensure rewards don’t violate anti-kickback statutes. Avoid personal gifts, opt for training, support upgrades, or donation credits.

Get Your Books Right

Understand GAAP:

Discounts and credits reduce recognized revenue

Gifts fall under sales/marketing expenses Track and classify appropriately to avoid reporting issues.

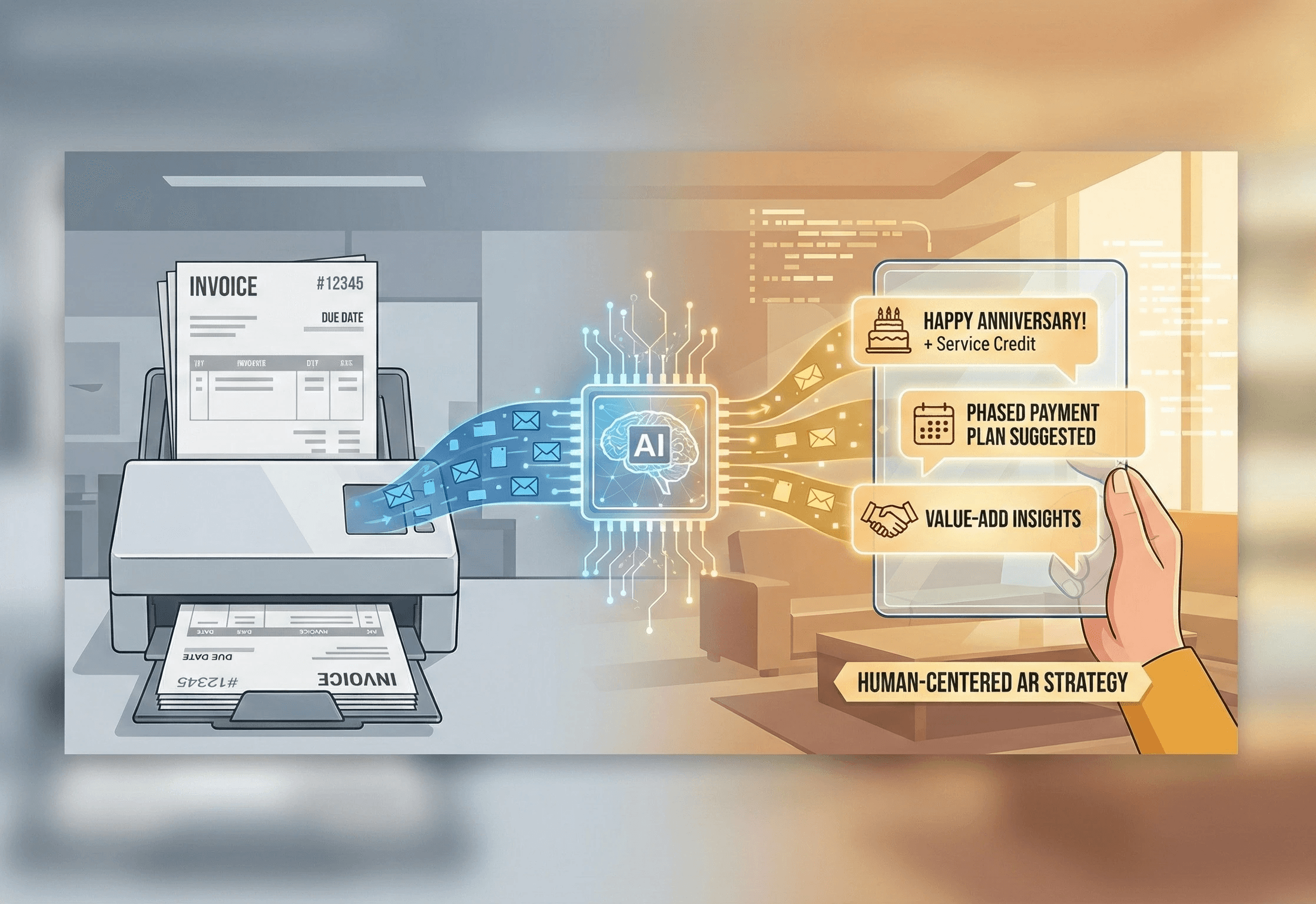

The Future of AR Is Human-Centered

As AI becomes more embedded in finance operations, AR will no longer be isolated from customer experience. Future invoices will come with smart messaging, timely insights, and personalized value-adds.

Imagine an AI agent that knows a client’s fiscal year-end and suggests a phased payment plan. Or one that celebrates a client’s company anniversary with a surprise service credit.

By shifting from a collections mindset to a celebration strategy, businesses build not just stronger cash flow, but stronger relationships.

Action Plan for AR Professionals

Review every automated message: add warmth, gratitude, and brand voice

Segment customers and tailor recognition

Pilot a public recognition or rewards program

Use Abivo to automate tasks and identify appreciation opportunities

Work with legal and accounting to document incentive structures

Abivo: Automating Gratitude at Scale

Abivo empowers your AR function with AI-powered email and voice agents that blend human warmth and operational scale. From proactive nudges to automated thank-you's, Abivo enables your team to reduce DSO without increasing headcount, while leaving your clients feeling respected, not chased.